By Michelle Schulz, Lindsay Forbes and Marina Mekheil, Schulz Trade Law, PLLC

This article was prepared as part of a presentation by Schulz Trade Law at the 33rd Annual International Law Institute hosted by the State Bar of Texas International Law Section in Houston, Texas on May 16, 2024.

The globalization of business operations and heightening global tensions have transformed the landscape of international trade. In response, U.S. trade enforcement agencies have evolved their priorities and enforcement strategies to meet U.S. economic, national security, and foreign policy objectives. These shifts present challenges for U.S. companies attempting to navigate complex international trade regulations. Even sophisticated companies with complex, global operations may not fully understand the implications trade regulations have on their day-to-day business. This article aims to provide attorneys a foundational understanding of recent key U.S. trade enforcement trends and strategies so they may better counsel their clients about international trade issues.

Customs Regulatory Enforcement Trends

U.S. Customs and Border Protection (CBP) maintains a list of priority trade issues for the importation of merchandise into the United States. Among these, we have observed CBP is currently focusing its enforcement efforts on two primary issues: (1) evasion of tariffs combatting unfair international trade practices through Antidumping and Countervailing Duties (AD/CVD); and (2) the prohibition against importing products derived from forced labor practices in the Xinjiang Uyghur Autonomous Region (XUAR) of the People’s Republic of China.

Antidumping and Countervailing Duties

Antidumping and Countervailing Duties are tools the U.S. Government uses to combat unfair trade practices of foreign economies and governments. “Dumping” occurs when a foreign party sells a product into the United States at a price that is below “normal value,” or the price at which the foreign producer sells the merchandise in its own domestic market. Additionally, some foreign governments severely subsidize domestic enterprises or industries through direct cash payments, credits against taxes, or loans at terms that do not reflect market conditions. The

U.S. Government levies Antidumping and Countervailing Duties to offset the financial impact of “dumped” and subsidized products imported into the United States and level the playing field for domestic U.S. industries injured by these trade practices.

The International Trade Commission (ITC) investigates merchandise sold into the United States at low or subsidized prices. When the ITC determines the U.S. market was injured due to unfair trade practices, it issues scope orders to identify certain categories of products at high risk of dumping or subsidization from specific countries. CBP then imposes and collects tariffs – sometimes over 1000% more than the duties normally applicable to those goods – to offset the unfair prices. Some U.S. importers have attempted to evade these duties and illegally import these goods by misrepresenting the nature of the merchandise or the country of origin. For example, a supplier may ship the goods to a country outside the scope of an AD/CVD order and complete minor modifications to the goods in that country, and the importer avoids paying AD/CVD duties by claiming the country of origin is the country in which minor modification occurred.

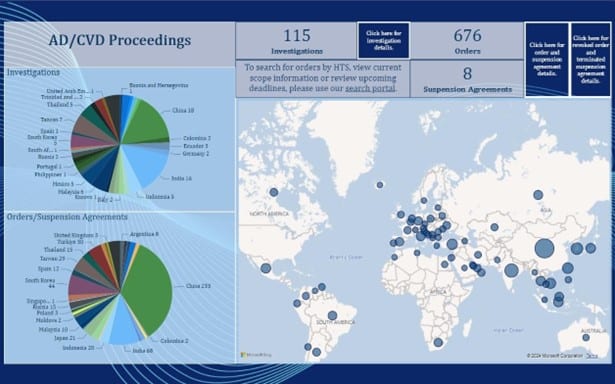

In response, the Department of Commerce has initiated investigations to detect and prevent such circumvention. Commerce uses these investigations to expand the scope of existing AD/CVD to countries where circumvention is occurring. The most notable AD/CVD “circumvention” order to date is an order imposing AD/CVD on solar cells and modules from Cambodia, Malaysia, Thailand, or Vietnam using Chinese components. AD/CVD enforcement is on the rise, and we expect this trend to continue for the foreseeable future.

Attorneys should warn clients who import merchandise subject to AD/CVD scope orders and merchandise from high-risk countries that CBP can, and likely will, request supporting documentation to ensure importers are paying the correct duties. Evasion and failure to produce supporting documentation may result in significant penalties.

The Uyghur Forced Labor Prevention Act (UFLPA)

Congress enacted the Uyghur Forced Labor Prevention Act on December 23, 2021. The UFLPA intends to combat forced labor practices in the XUAR. The law establishes a rebuttable presumption that goods mined, produced, or manufactured wholly or in part in the XUAR or by an entity on the UFLPA Entity List in 19 U.S.C. § 1307 are prohibited from entry into the United States under Section 307 of the Tariff Act of 1930. Importers must establish, through clear and convincing evidence, that goods produced in the XUAR or by listed entities were not produced using forced labor and that the UFLPA does not apply.

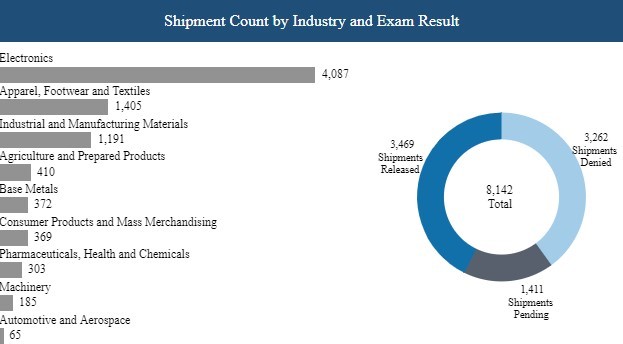

CBP targets products commonly produced in the XUAR with forced labor, such as cotton, tomatoes, and silica-based products. These upstream goods are often incorporated into other finished products across a wide range of industries, including aerospace, automotive, textiles, apparel, base metals, electronics, manufacturing, pharmaceuticals, and other consumer product categories. Since 2022, CBP has held over $1.3 billion of goods for investigation and denied over 3,000 shipments after finding the imported goods were manufactured using XUAR forced labor.

The ULFPA creates an obstacle for businesses, as complex supply chains that touch the XUAR are susceptible to contamination by goods made using forced labor. Threats that increase the risk of goods infiltrating the U.S. supply chains include lack of supply chain visibility, commingling inputs made with forced labor into otherwise legitimate production processes, and intentional evasion of UFLPA prohibitions by upstream suppliers.

Importers often do not have visibility into the early stages of the manufacturing process. Forced labor often occurs at this initial supplier level, including the extraction of raw materials and the harvesting of agricultural products. However, CBP expects importers to fully vet their supply chain through all stages of the manufacturing process. This can be especially challenging for importers given the lack of transparency of labor practices in the People’s Republic of China and other manufacturing economies.

CBP expects importers to undertake heightened due diligence to identify potential supply chain exposure to companies operating in or with the XUAR. Proper due diligence includes developing a supply chain vetting process and controls, communicating and training UFLPA requirements across the supply chain, monitoring transactions, establishing preventative and corrective measures, and conducting internal and independent audits. These procedures will help importers select compliant suppliers and hold violative suppliers accountable for their role in forced labor.

In an investigation, CBP will also request clear and convincing evidence of supply-chain tracing to demonstrate goods were not produced in XUAR. A business’s best chance to mitigate the risk of violation and potential penalties is to perform proper due diligence and adhere to the importer guidance CBP publishes on its website. Attorneys counseling importers should be familiar with UFLPA requirements and warn their clients about CBP’s increasing enforcement efforts and due diligence expectations.

Sanctions Regulations and Enforcement

The U.S. Government has increasingly relied on sanctions to discourage foreign governments from engaging in behavior that threatens U.S. interests. The International Emergency Economic Powers Act (IEEPA) grants executive authority over emergencies during peacetime, allowing the U.S. President to address extraordinary threats to national security by reforming the economic policies of the United States. Under IEEPA, the President may issue Executive Orders authorizing the Department of Treasury, Office of Foreign Assets Control (OFAC) to enforce sanctions on financial transactions with countries, entities, and individuals.

For example, OFAC administers and enforces comprehensive embargoes against Cuba, Iran, North Korea, and Syria, as well as strict sanctions against Belarus and the Russian Federation resulting from the ongoing war in Ukraine. However, OFAC also issues sanctions against entities and individuals operating on behalf of embargoed countries, terrorist organizations, and narcotics trafficking organizations, as well as certain sectors such as the Russian oil and gas industry and the Chinese military-industrial complex.

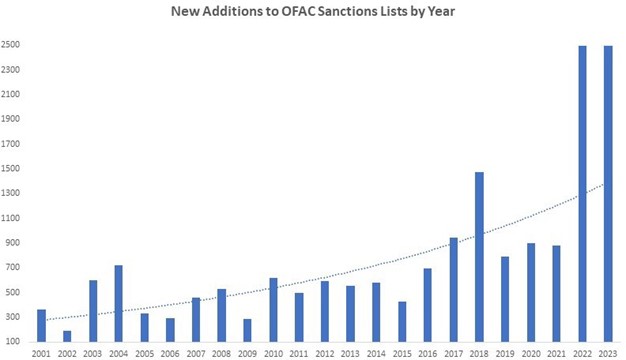

The sanctions change almost daily, and OFAC exercises extraterritorial jurisdiction over entities, people, and transactions that have any nexus to the United States. Even using a foreign subsidiary of a U.S. financial institution may establish jurisdiction for enforcement purposes.

1 Richard Manfredi, 2023 YEAR-END SANCTIONS AND EXPORT CONTROLS UPDATE GIBSON DUNN (2024), https://www.gibsondunn.com/2023-year-end- sanctions-and-export-controls-update/ (last visited Apr 26, 2024).

OFAC issued 16 public enforcement actions in 2023 totaling over $1.5 billion in penalties and settlements. We expect this enforcement trend to continue, as OFAC has already published two enforcement actions totaling over $23.7 million in 2024.

U.S. companies must monitor OFAC sanctions updates, screen all transaction parties, and perform comprehensive due diligence to detect and prevent potential sanctions violations. Attorneys should keep clients apprised of their sanction’s compliance obligations in not only day- to-day business transactions, but also organizational operations such as mergers, acquisitions, joint ventures, and foreign investments.

Export Regulatory Enforcement

The U.S. Department of Commerce’s Bureau of Industry and Security (BIS) enforces the Export Administration Regulations (EAR), as modified by the 2018 Export Control Reform Act (ECRA). The EAR governs the export, re-export, and transfer of U.S.-origin commodities, software, and technology. These regulations primarily control “dual use” items that may have both commercial and military applications. U.S. exporters may require a license from BIS before exporting certain goods, software, and technology. The license requirements depend on the technical characteristics of the item, software, or technology, as well as the destination, the end user, and the end use.

The EAR also contains anti-boycott provisions that prevent U.S. persons and companies from complying with aspects of foreign boycotts that the U.S. does not support. The most prominent example is boycotts of Israel. Under the anti-boycott provisions, U.S. persons may not comply with unsanctioned boycotts in the following ways:

- Agreeing to refuse or refusing to do business with boycotted countries or companies;

- Agreeing to discriminate or discriminating against other persons based on race, religion, sex, or national origin; and

- Furnishing information about business relationships with a boycotted country or a blacklisted entity.

The EAR requires U.S. persons to report any requests to comply with an unsanctioned foreign boycott, even if that request is not honored. In 2024, BIS publicly released a Requester List identifying parties who made such illegal requests.

BIS continues to ramp up enforcement of the EAR export control and anti-boycott provisions. The export control enforcement actions getting the most media attention relate to illegal diversion of goods to the Russian Federation and the People’s Republic of China, but exporters should be mindful that the EAR has country, end user, and end use specific provisions beyond these countries. Additionally, BIS has emphasized it will continue to prioritize enforcing the anti-boycott provisions and will issue penalties in those enforcement actions.

Attorneys counseling exporters should be mindful of U.S. regulations applicable to the export of goods, software, and technology to ensure clients comply with all licensing requirements. Additionally, attorneys should review quotations, contracts, letters of credit, and other agreements that may contain anti-boycott language so their clients may appropriately report illegal requests to BIS. As with import and sanctions regulations, compliance with both prongs of the EAR requires thorough due diligence and internal auditing.

Concluding Remarks

Attorneys must help their clients navigate dynamic and complex international trade regulations and enforcement trends. Ideally, attorneys and their clients should keep abreast of regulatory changes, implement strong due diligence practices, and monitor transactions and business operations for compliance with international trade regulations.

About Schulz Trade Law PLLC

Schulz Trade Law (STL) PLLC is a woman-owned trade law firm that specializes in guiding corporate clients through the regulatory complexities of international trade. The firm’s highly experienced trade attorneys, non-attorney trade analysts, and advisors offer robust support in export and import compliance and enforcement matters. STL serves a wide variety of industries such as aerospace, oil and gas, software and technology, manufacturing, transportation, food and beverage, and healthcare. STL is well known for creating forward-thinking strategies that are legally compliant. Among other areas, their decades-long experience involves preparing voluntary self-disclosures, due diligence for mergers and acquisitions, ITAR licensing and agreements, export license submissions, trade compliance audits, responding to inquiries and directed disclosures, and implementing safeguards to ensure clients satisfy the US government’s human rights requirements.