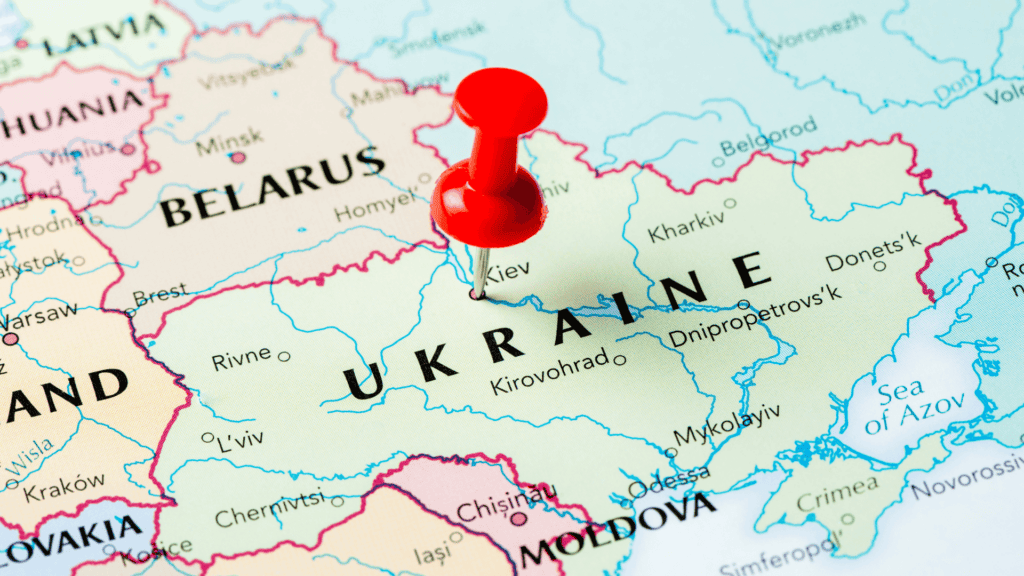

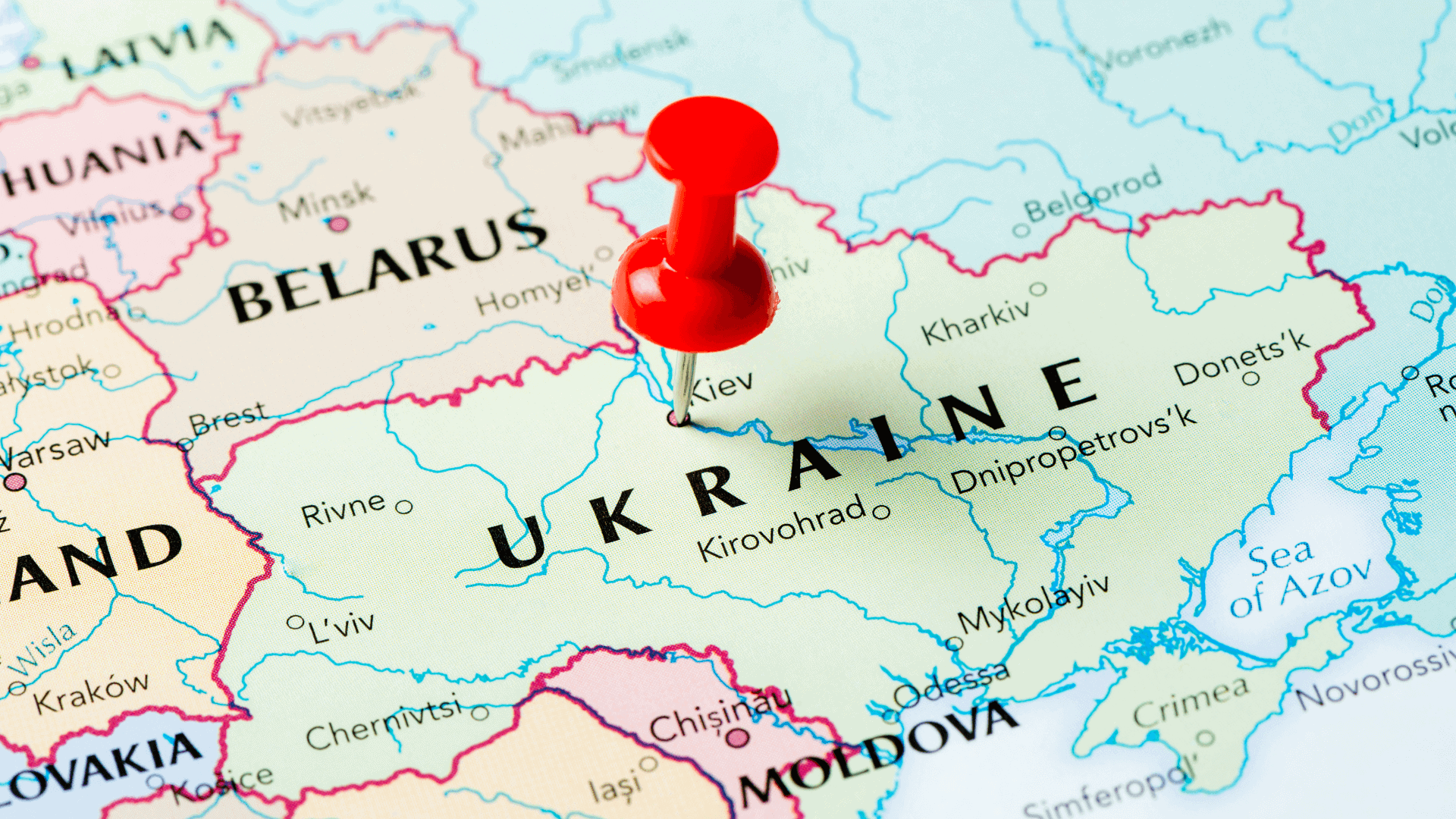

One year ago, Russia launched a military invasion of Ukraine in a major escalation of the Russo-Ukrainian War. In response to Russia’s actions, the international community imposed strict sanctions, export and import controls, and other measures on Russia. These measures have had a significant effect on global companies operating in Russia, leading a number of them to suspend operations there or even exit the Russian market altogether.

Restrictions have increased and evolved over the past year, resulting in unique challenges for companies trying to comply with the overlapping web of international sanctions on doing business in or involving Russia. Below we highlight six trends and takeaways from the past year with respect to compliance with sanctions, export and import controls, and other restrictions on Russia.

The Russia Restrictions Introduce New Concepts and Compliance Challenges

Sanctions on Russia are unprecedented in terms of both the numbers of restrictions imposed and the nature of those restrictions. The volume of sanctioned persons and controlled items targeted is greater than under previous regimes. But in addition to the sheer volume of the sanctions, the new measures have also introduced new sanctions concepts across the various jurisdictions, such as broad services restrictions, a full transaction ban for certain Russian state-owned enterprises, and a price cap mechanism on Russian oil and petroleum.

One of the most challenging aspects of the expansion of sanctions for compliance and transactional professionals has been the ratcheting up of restrictions on the provision of certain services. While the United States has previously imposed bans on the provision of all types of services, these restrictions are unique in prohibiting the provision of only certain types of services to persons in Russia (with limited exceptions). This approach creates challenges for companies trying to assess and understand exactly what types of activities fall within the scope of the covered services, as those sectors are defined. Further, the types of services covered are broad but not always aligned across the various sanctions regimes. Affected sectors include accounting, auditing, tax consulting; business and management consulting or public relations; advertising; architectural and engineering; investment services; IT consultancy and design; quantum computing; legal advisory services; and trust and corporate formation services. Despite broad alignment among the EU, UK, and United States, these measures have been implemented in different ways, with different exceptions and licensing grounds and even at different times across the jurisdictions.

The main challenge for companies seeking to comply with this new menu of sanctions is the constant need to keep evaluating internal compliance policies as new categories of measures are introduced. In addition to ensuringthat sanctions screening takes into account the latest changes and items are appropriately classified against new types of trade restrictions, the new restrictions may affect unexpected areas of operations, as is the case for services restrictions. The services restrictions affect almost all global companies operating in Russia through an entity, branch, or representation office, regardless of the sector in which they are active. The range of issues raised by the services restrictions is broad, including the ability to provide certain intragroup services (legal advisory services, IT services, auditing, bookkeeping, etc.) within a global company that may rely on services centers in one jurisdiction to cover an entire region, including Russia. The restrictions may also affect the ability to use trust structures in the context of debt restructuring or insolvency proceedings involving any Russian persons, and the ability to provide of legal advice or deal support to companies with Russian operations and assets, including in the context of acquisitions and other transactions.

Export Control Restrictions Are Becoming an Increasingly Important Foreign Policy Tool

“Traditional” sanctions measures have typically targeted the flow of money and credit to sanctioned or restricted persons. The sanctions targeting Russia certainly encompass those traditional measures but also include novel and increasingly complex export control restrictions on the flow of goods, software, and technology to Russia, including restrictions on exports, sales, reexports, and transfers of items to even nonsanctioned persons in Russia. This reflects a growing trend over the last several years of placing more emphasis on export controls as a foreign policy tool. That is, export controls are now being used more frequently and in a unique way as an enforcement tool to address issues of national security.

Recent export-related restrictions on Russia are also unique in the context of traditional export control measures. In particular, “commercial” items that are not controlled as military or dualuse items (i.e., those classified as EAR99 under U.S. export controls, and those that would not require an export license under EU or UK export controls) usually would not be controlled for export. However, in addition to the “traditional” export restrictions targeting military or dual-use items, the United States, EU, and UK have each imposed restrictions on the exports of thousands of “commercial” items to Russia. For this reason, it is no longer sufficient to simply confirm the “traditional” export classification of the item through, for example, an export control classification number; rather, companies need to also check whether the item is listed or described on any Russia-related export control lists maintained by relevant authorities by comparing its tariff code (HS code) and description against relevant lists.

We expect to see export controls increasingly used as a foreign policy tool, both in the context of restrictions on Russia and in response to other perceived national security threats.

Import Restrictions Highlight the Importance of Country of Origin Determinations and Supply Chain Tracing

The flurry of import restrictions put in place by governments around the world last spring and summer, such as prohibitions on the import of certain Russian-origin goods and suspension of normal trade relations (resulting in an increase in the duty rate applied to Russian goods), brought into focus the importance of accurate classifications, country of origin determinations, and supply chain due diligence.

While most trade compliance programs have controls regarding classification, many companies struggle with implementing appropriate country of origin, and country of origin marking, procedures — especially multinational companies that import into a number of jurisdictions with different rules and requirements. Furthermore, supply chain due diligence measures are only starting to become standard aspects of trade compliance programs as trade restrictions, such as those discussed in this alert, spotlight their significance. Indeed, although trade levels of wholly produced or obtained goods from Russia were already low prior to the announcement of Russia trade restrictions, many more imported articles incorporate Russian content. As such, companies must understand not only where the inputs to produce their goods come from but also whether the manufacturing process substantially transforms those inputs in the country of production according to the rules of the country into which the goods are

imported. For example, U.S. Customs and Border Protection has increasingly used the “essence” test to determine the country of origin of products. If a product that contains meaningful Russian-originating content does not undergo a substantial transformation under this test prior to importation into the United States, it could be subject to the increased duties on Russian-origin goods. Controls and procedure regarding country of origin determinations and supply chain tracing are, therefore, critical to ensuring import compliance, particularly as governments continue to use trade restrictions as a foreign policy tool (e.g., the threatened 200% tariff on Russian-made aluminum imported into the United States, the recently implemented Uyghur Forced Labor Prevention Act, and similar measures).

There Are Attempts to Prevent Circumvention of Sanctions Through Targeting of Third-Country Actors

Countries imposing sanctions targeting Russia are conscious of the need to prevent the circumvention of their measures to reinforce their credibility. To do so, such countries have imposed measures targeting the evasion of sanctions by third-country actors by trying to control the activities of third-country actors that may be less incentivized to apply Western sanctions.

In this respect, the United States is known to apply its sanctions and export control laws extraterritorially, through, for instance, the use of secondary sanctions. While the EU and the UK have been in the past critical of the use of such tools by the United States, the Russia sanctions crisis has brought on a policy shift, at least in the EU’s approach.

In particular, the EU has taken steps to discourage non-EU persons (which would normally not be required to comply with EU sanctions in the context of a given transaction, except in specific circumstances) from engaging in actions contrary to EU sanctions. The most emblematic move in this respect is the broadening of the designation criteria to empower the EU to designate any individual or entity facilitating the circumvention of EU sanctions (e.g., a third-country company buying goods in the EU to bring them to a third country and then Russia). To date, the EU has not yet used this new power but might do so against entities in the United Arab Emirates, Mali, and Iran accused of selling prohibited equipment to Russia, in the context of the 10th EU sanctions package currently being negotiated.

In addition to the expansion of the EU’s authority in this respect, several countries are reinforcing the reporting requirements on their operators to prevent breach and circumvention of sanctions, creating positive obligations on companies to supply regulators with certain information related to sanctions compliance. For instance, the EU now requires EU operators (which include any EU individual or entity active in any given sector) to communicate immediately any information about funds and economic resources in the EU of designated persons that have not been treated as blocked in violation of an asset freeze by persons that should normally be required to block them.

Asian Countries Are Catching Up on the Sanctions Game

While the United States, the EU, the UK, and Canada have historically been at the forefront of the imposition of sanctions in the last decade, the war in Ukraine led certain countries that are not traditionally using unilateral sanctions tools to impose their own set of sanctions against Russia, in a rather unprecedented move.

For example, a number of Asian nations, such as Japan and Singapore, imposed sanctions targeting Russia in the course of 2022 and early 2023, respectively.

Japan successively imposed a wide range of asset freezes, as well as trade and financial restrictions, on Russia that partly overlap with U.S., EU, and UK measures. Significantly, Japan also imposed far-reaching export prohibitions on dual-use goods, luxury goods, and goods that may strengthen Russia’s industrial base (similar to the lists of goods subject to increased controls under U.S., EU, and UK export) and import prohibitions on Russian precious metals and Russian crude oil above the price cap, among others. Japan further restricted access to its capital markets to Russia by implementing various prohibitions on trading in Russian sovereign debt in the primary and secondary markets in Japan and issuance of bonds from certain Russian banks. In addition, Japan moved to ban the provision of certain trust services, accounting and auditing services, and business management consulting services to Russia and subjected new Japanese direct investment in Russia to approvals.

Singapore imposed a ban on exports of certain items to Russia, including military equipment and certain dualuse items and prohibited the provision of financing or financial services in relation to exports of those goods from Singapore or any other jurisdiction. On the financial side, Singapore implemented various measures, such as the designation of four major Russian banks and any entity directly or indirectly owned or controlled by, or acting on behalf of or under the direction, of such banks; a prohibition on dealings of new securities and provision of financial services facilitating new fundraising by the Russian government, the Central Bank of Russia, and their related entities; a prohibition on transactions or financial services in relation to certain sectors in Donetsk and Luhansk (transport, telecommunications, energy, oil and gas, mineral resources); and a prohibition on any cryptocurrency or digital payment token transactions where the proceeds or benefits of such transaction may be used to facilitate any of the previously mentioned prohibitions.

Unprecedented International Coordination on the Imposition of Restrictions on Russia Increases Compliance Risks

In response to Russia’s invasion of Ukraine, the United States, UK, EU, and other allies and partners formed a coalition to implement sanctions and export controls on Russia. This unprecedented level of coordination (outside the scope of United Nations Security Council resolutions) resulted in parallel — though not identical — regulatory policies and controls across the United States, UK, EU, and others, which has produced a much greater impact on Russia than traditional unilateral sanctions and export controls could have achieved alone.

Western countries are seeking to capitalize on this success and replicate this multilateral cooperation in the enforcement arena, including by sharing best practices and information on investigations and enforcement. Some steps have already been taken in this direction, including the announcement of an enhanced partnership on sanctions implementation and enforcement between the UK Office of Financial Sanctions Implementation and the U.S. Department of the Treasury Office of Foreign Assets Control and the establishment of the broader U.S.-EU Trade and Technology Council. There does not yet, however, exist an international mechanism for open information sharing and cooperation among other allies. Within the EU itself, there is a proposal to revamp the sanctions enforcement framework to ensure cooperation and information sharing among Member States and the European Commission on ongoing investigations and prosecutions of EU sanctions violations.

Even ad hoc enforcement information sharing increases the risk of a company’s facing investigations in multiple jurisdictions, and companies should weigh these considerations when choosing to disclose potential violations. Not all jurisdictions have clear disclosure processes or incentives, and while some countries settle violations only administratively, other jurisdictions may prosecute the same conduct as a criminal offense. These risks will likely increase should the United States, EU, UK, and their allies create a more formalized and open enforcement information-sharing platform.

The trends discussed here make it challenging to stay abreast of the sanctions on Russia, which change frequently and are applied in different ways across various jurisdictions. Novel types of restrictions may require the imposition of new internal controls appropriately tailored to the risks presented by doing business in or involving Russia. Regulators have a clear focus on targeting third-country actors that may participate in sanctions evasion. For this reason, any company with a global footprint should carefully consider the implications of Russia sanctions before engaging in any transaction in or involving Russia. Further, increased coordination and information sharing across jurisdictions may increase enforcement risks. Sidley has trade compliance capabilities in the United States, EU, UK, Singapore, and Japan and continuously advises on best practices and compliance with Russia sanctions.

NOTE: Reprinted with permission from the author. The views expressed in this article are exclusively those of the author and do not necessarily reflect those of Sidley Austin LLP and its partners. This article has been prepared for informational purposes only and does not constitute legal advice. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. Readers should not act upon this without seeking advice from professional advisers.

By Sidley Austin